Cost-effective strategies that level the playing field

At TAC we see things a little differently. We believe that

small can be powerful. We envision small companies with access to the same benefits solutions as their larger counterparts. . . and we make it happen.

Sought after strategic advisors

TAC is known for doing things differently. We are disrupters with more than 50 years of experience navigating healthcare and insurance systems and we stay ahead of trends to bring you the best ideas, first.

Innovative funding strategies for small groups

Hands-on claims resolution for your employees

Voluntary benefits expanding your program at little or no cost to you

Proactive guidance to avoid issues

Protection for your company’s interests

Champions for you and your employees

Access to the medical insurance marketplace

We don’t represent carriers, we represent you. TAC is your advocate, negotiating with carriers to deliver the most comprehensive coverage at the most competitive price. Our relationships with carriers are extensive, nationwide and span companies large and small, including the best known:

- Blue Cross/Blue Shield

- United Healthcare

- Cigna

- Aetna

- Regional carrier access

Self funding

Control claims, reduce costs

Self-funding allows you to offer quality health insurance with lower costs for you and your employees. Rather than pay monthly premiums, you pay employee claims along with some fixed costs. Because employee claims are visible, they can be actively managed, and savings can be secured.

Benefits of self-funding

Proactive risk control

More transparency and flexibility

Freedom in plan design

Cost management

Protection from large claims

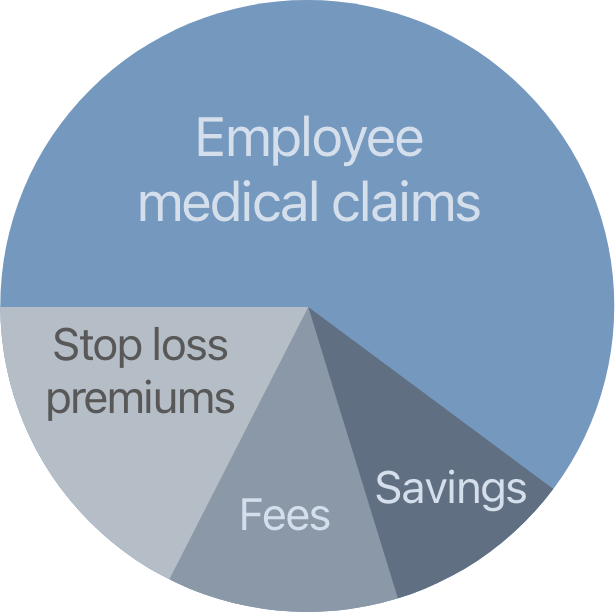

Self funding simplified

Controlling employee medical claims increases your savings

Traditional insurance

Self funding

Self-funding expertise

Stop-loss insurance, third-party administrators and ERISA compliance make self-funding more involved than off-the-shelf plans. TAC has decades of experience managing the complexities so it’s simple and cost-effective for clients.

Level funding

Stabilized monthly costs, unused funds returned

Level funding allows companies to safely transition to self-funding by offering stable monthly costs and protections to limit liability. Best, if employee medical claims are lower than the funds you pay in for the year, a check for the difference will be sent to you.

Benefits of level funding

Predictable monthly costs

Multiple deductible and coinsurance options

Flexible plan design options

100% of unused claim reserve returned

Access to detailed claim data and analytics

RBP

Bending the cost curve

One of the best cost-management tools available, referenced-based pricing (RBP) delivers savings for both the employee and the employer. It provides employees with upfront pricing for services so they can make informed decisions, and virtually eliminates medical bills for the balance between providers’ charges and their Medicare reimbursement.

Benefits of RBP

18 – 22% savings versus typical medical program costs

Upfront pricing information for medical services

Patient support teams to establish agreed upon reimbursements

Best-in-class bill negotiation

Sustainable, high-quality insurance offerings

Captives

Total control and bottom-line benefits

With captive insurance you have ownership in the insurance company and participate in the underwriting profits. In a captive, you join forces with other employers to share risk and reward. Is a captive right for you? TAC Benefits Group can help you decide.

Benefits of Captives

Broader coverage

Profit and investment income potential

Stablized costs and greater program control

Aggressive claims management

Specialized loss control services

Freedom to use unbundled services

Additional benefits

Wellness programs

Want to help your employees improve their health? We offer wellness programs that educate, motivate and empower individuals to make lasting lifestyle changes such as smoking cessation, weight loss, stress management, and exercise.

EAP programs

TAC provides access to Employee Assistance Programs (EAPs) with counselors to guide individuals who have personal issues such as grief, work stress, caring for children and aging parents, divorce, substance abuse and financial and legal matters.

Tax-advantaged health savings accounts

Both FSAs and HSAs allow employees to pay for eligible medical expenses on a pre-tax basis, thus reducing their taxable income. TAC offers both. The difference is that with FSAs, funds must be used during the year or they are lost. With HSAs, employees can leave money they don’t need in the account year after year until age 65 and withdrawals for qualified healthcare expenses are tax-free.

CONTACT US

ADDRESS:

540 Pennsylvania Ave Suite 230 Fort Washington, PA 19034PHONE:

215-663-8000E-FAX:

Sales: 215-693-5831 Service: 215-693-5836